Bitcoin and the US Bond Market

Over recent months, the US bond market has experienced sharp volatility, with 10-year Treasury yields driven higher partly by rising term premia and growing fiscal concerns — moves that have coincided with a weakening US dollar.

Introduction

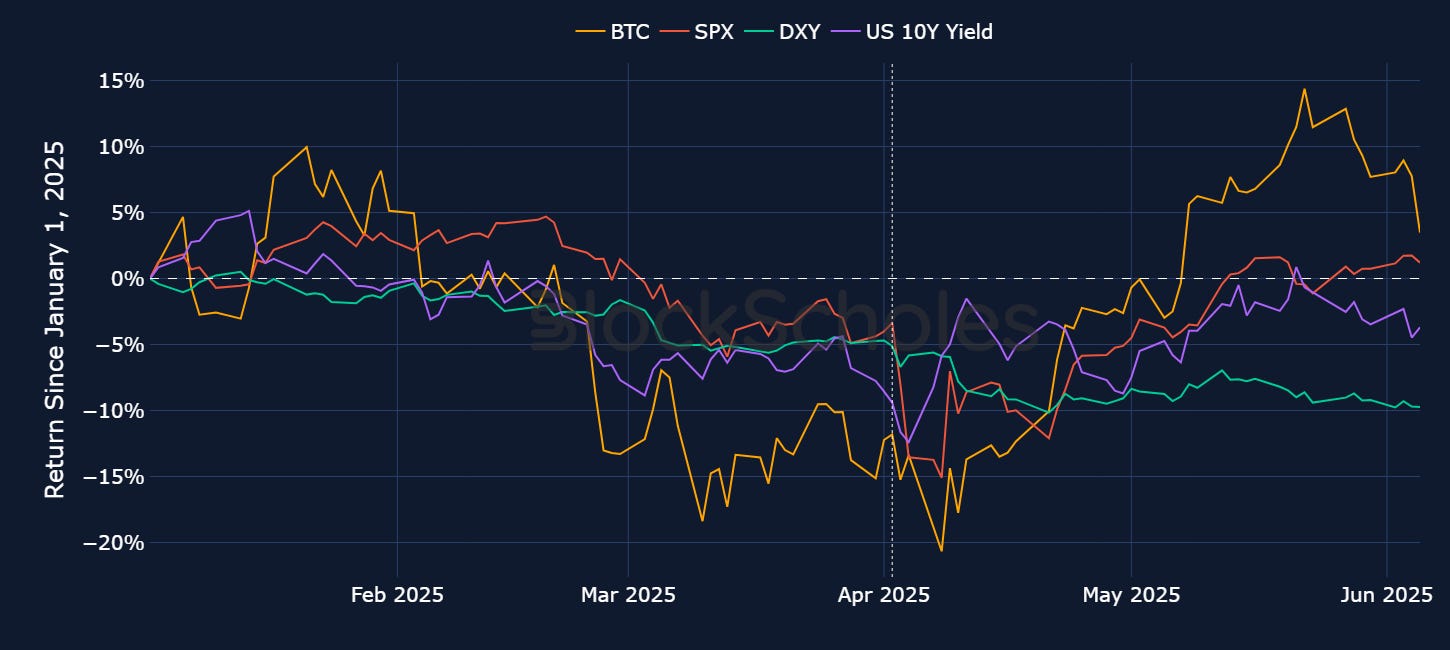

Over the past two months, financial markets were faced with a simultaneous, yet unusual selloff in assets often regarded as safe havens such as US treasuries and the US dollar, as well as in risk-on assets, such as US equities and Bitcoin. A big part of those moves followed President Trump’s so-called “Liberation Day” tariffs, the most protectionist trade policy announcement in the US in over a century.

The US bond market, in particular, has been upended by Trump’s tariff blusters. Intraday, the 10-year treasury yield dropped to as low as 3.8%, while finding a ceiling as high as 4.6%. President Trump even later claimed “the bond market is very tricky” after he paused the “Liberation Day” tariffs for 90 days on April 9.