Bitcoin Reached its Lowest Level Since Trump’s Re-election

Crypto markets extended their rout, with BTC briefly sliding to a 15-month low near $72,000 and dragging total crypto market cap down by roughly $500B since end-January.

Find out our latest reports, listed below:

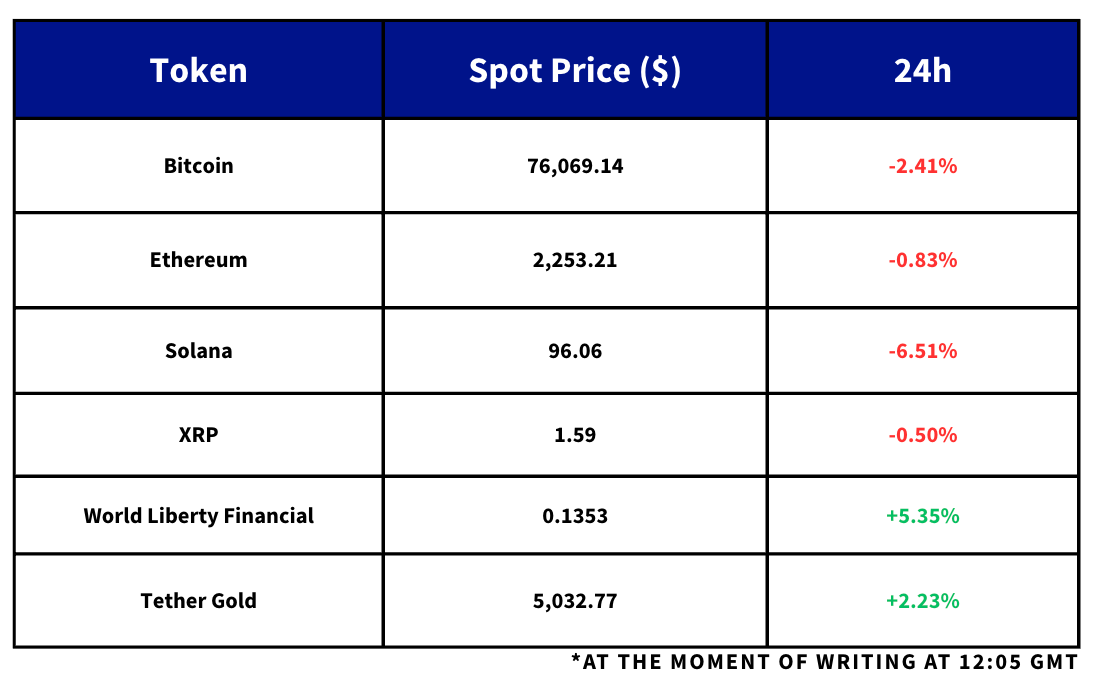

Market Snapshot: Overnight Moves

Daily Updates:

The rout in crypto assets continued over the last 24 hours with BTC intraday falling to a 15-month low of $72,000 — a level it last traded at since President Trump’s re-election back in November 2024.

That drop to $72K not only meant BTC fell lower than the post-Liberation Day low, it also dragged the rest of the crypto market down, which has seen its total market-cap drop by nearly $500B since the end of January.

Spot Bitcoin ETFs were unable to continue their net acquisition for a second day in a row, resulting in $272M in outflows yesterday, following a sizable inflow last Friday of $561.8M.

Derivatives markets also provide little respite and continue to price for a further slump in prices. BTC and ETH funding rates briefly turned negative earlier this week (though they trade close to neutral now), while volatility smile skews for both assets are significantly tilted towards put contracts. The 7-day skew for BTC trades at -8%, while for ETH, put options have an 11 volatility point premium over calls.