BTC Dominance Declines Further

BTC’s bounce above $93k faded, with price back near $90k, even as majors outperformed (ETH +0.27%, SOL +1.54% vs BTC -0.14%). Spot flows remain a headwind: BTC ETFs sold $372.8M and ETH $74.2M, while IBIT alone saw $523M out

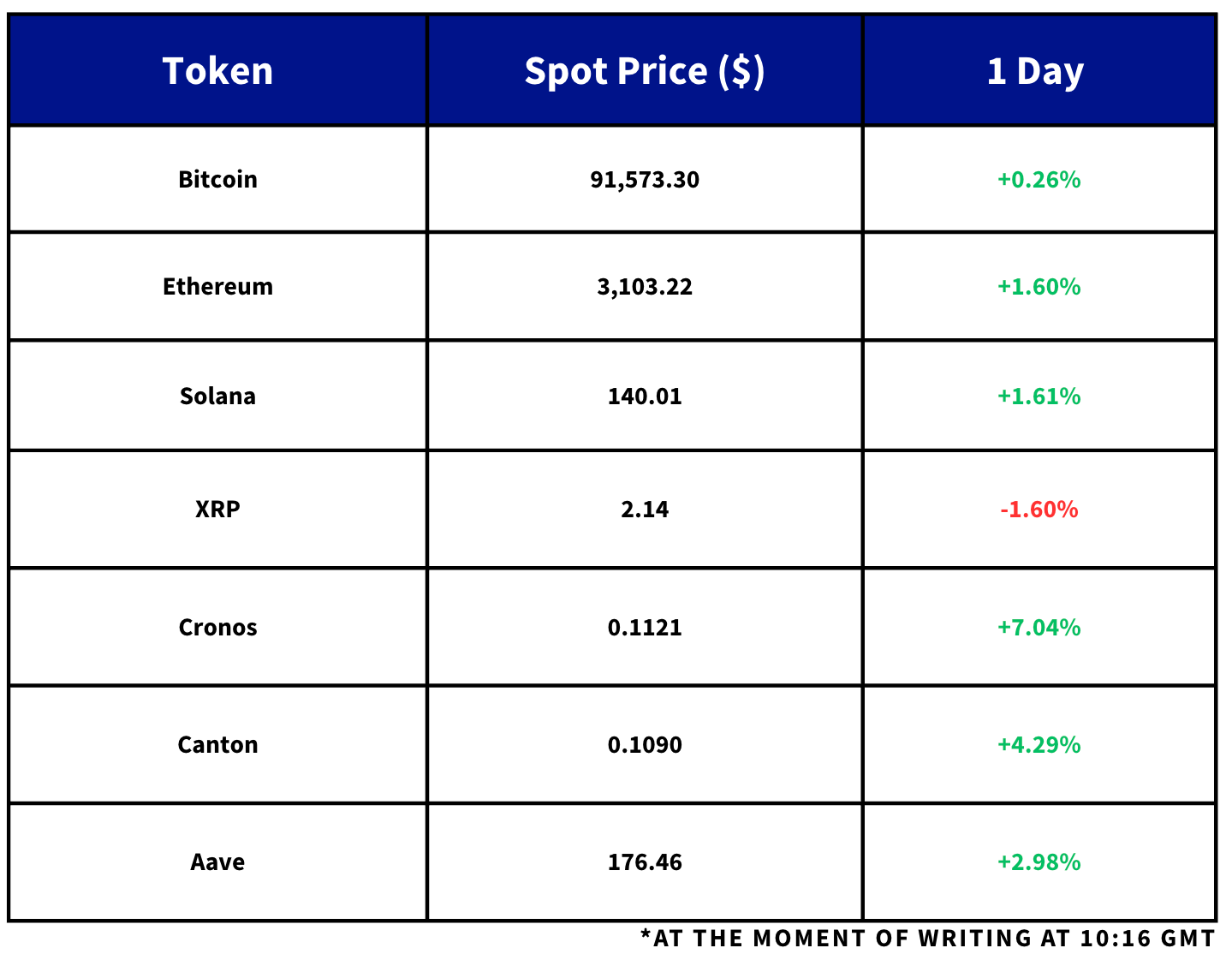

🪙 BTC heavy, alts a touch firmer

BTC keeps leaning on $90K after a failed bounce, while ETH and SOL are slightly green on the day and BTC dominance has dropped, even as spot BTC and ETH ETFs see ongoing outflows.

📉 Markets cautious, BTC downside still in focus

ETH vol has largely re-flattened, but BTC’s curve stays inverted with short-dated puts richly bid, reflecting more concern about near-term BTC downside than ETH.

🏗️ Infra and product build-out continues

Kraken raised $800M at a $20B valuation, New Hampshire approved a $100M BTC-backed bond, and Fidelity launched a staking-enabled Solana ETF (FSOL) with fees waived until mid-2026.

⚡️ Free readers stop here. Paid subs get our full daily market snapshot — quick, clear, and easy to follow.

👉 Upgrade to paid to unlock the full experience and stay ahead, every single day.

Find out our latest reports, listed below:

Market Snapshot: Overnight Moves

Daily Updates:

A modest rebound past $93K yesterday quickly fizzled out, and BTC once more fell to $90K before bouncing off that level. Interestingly, over the past 24 hours, altcoins have shown stronger resilience relative to BTC. ETH is up 0.27% over the same period, SOL is up 1.54%, while BTC trades 0.14% lower.

Additionally, it is interesting that BTC dominance (including stablecoins) has dropped from 59.36% to 55.75% in the past 24 hours. The drop in BTC’s spot price alongside a decline in its market-cap dominance adds some more evidence to altcoins holding up slightly stronger in yesterday’s session.