Block Scholes x Bybit Crypto Derivatives June 19

The conflict in the Middle East left its mark on the trading volume of perpetual swap contracts, as well as on funding rates, which have turned negative for a slew of tracked tokens.

Key insights

The conflict in the Middle East left its mark on the trading volume of perpetual swap contracts, as well as on funding rates, which have turned negative for a slew of tracked tokens. Market-wide de-risking over fears of a worsening Iran-Israel conflict has also resulted in a sea of red for crypto assets over the past week. BTC is down more than 4%, ETH more than 8% and SOL 10%. Nevertheless, ETH options markets are carrying a less bearish tilt toward OTM puts (relative to BTC short-tenor options), and for expirations beyond 30 days, the ETH put-call skew is positive.

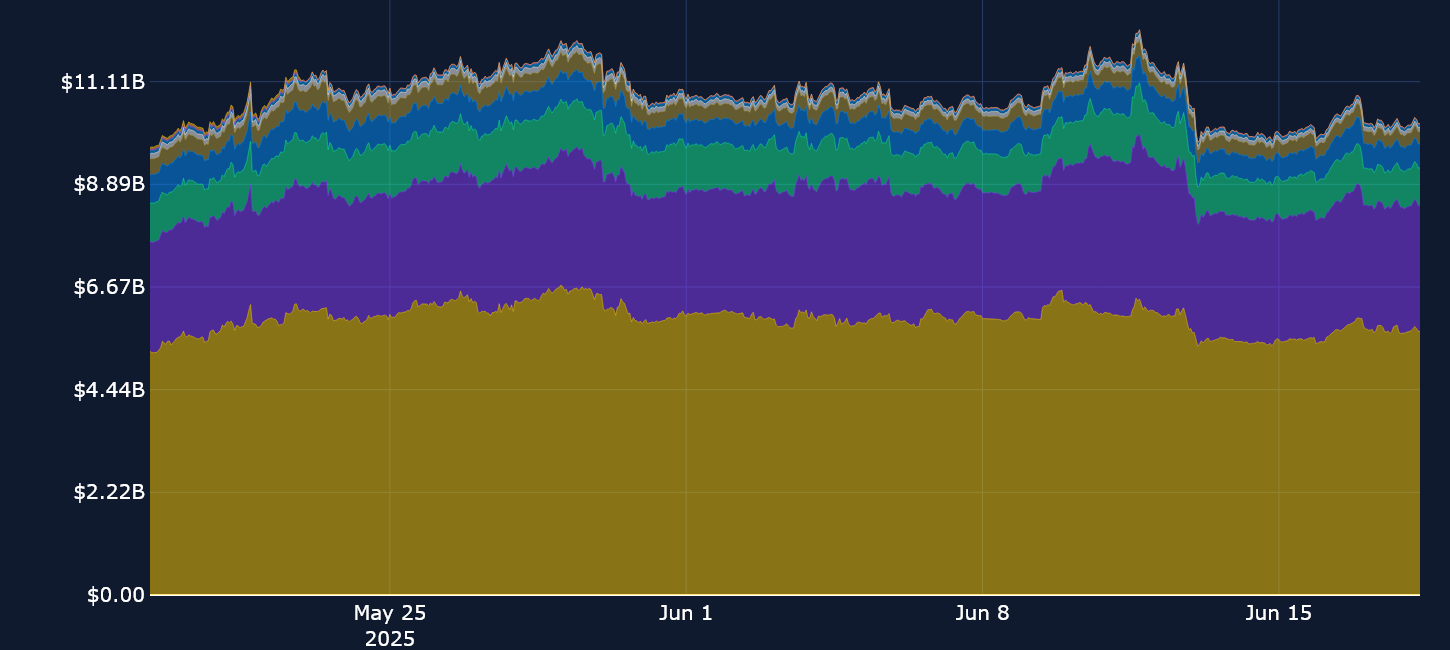

Perpetuals: This week, open interest has fallen from its June highs, and has mostly been sideways above $9B. Funding rates dipped negative on the back of escalation fears.

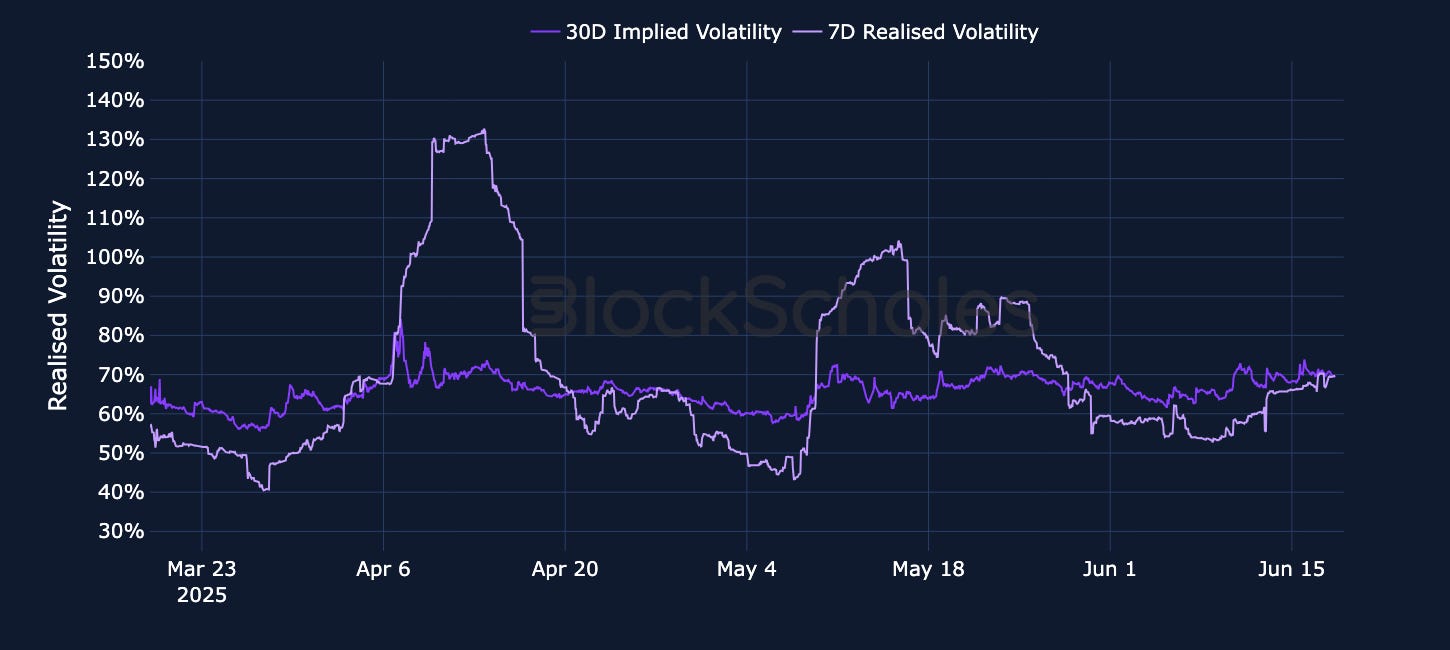

Options: Short-tenor implied volatility for BTC options continue to trade at just under half of the implied volatility for equivalent tenor ETH options, while 7-day realized volatility for BTC remains at 30%, compared to 70% for ETH.

Block Scholes BTC Senti-Meter Index

Block Scholes ETH Senti-Meter Index

Block Scholes’s Senti-Meter Index aggregates the funding rate, future-implied yield and volatility smile skew into a single expression of sentiment in derivatives markets. See more in the methodology article here.

Macro, tech & regs

Macro calendar & recent events

China retail sales for May — Jun 16, 2025 — Year-over-year retail sales in China jumped 6.4%, far exceeding economists’ expectations of a 4.9% increase.

US retail sales for May — Jun 17, 2025 — Retail sales in May dropped for a second consecutive month, with retail purchases decreasing 0.9% as compared to April — the largest monthly decline since the start of the year.

US FOMC meeting — Jun 18, 2025 — The FOMC is expected to hold its benchmark interest rates between 4.25–4.5%, marking the fourth rate pause this year.

UK CPI inflation for May — Jun 18, 2025 — Headline CPI in May fell to 3.4% year-over-year, in line with expectations and down from 3.5% in April.

UK Bank of England monetary policy meeting — Jun 19, 2025 — The Bank of England is expected to keep its bank rate on hold at 4.25%.

Japan CPI inflation for May — Jun 20, 2025 — Headline CPI in Japan is expected to decrease to 3.5% from 3.6%, following the BoJ’s decision earlier this week to hold interest rates at 0.5%.

ETH Spot ETFs continue to surge — Excluding Jun 13, 2025, when ETH Spot ETFs saw a small $2.1M outflow, ETH Spot ETFs have maintained their strongest run of positive inflows since the November-December 2024 election period.

Trending news

In a 68–30 vote yesterday, the US Senate passed the GENIUS Act, the first stablecoin legislation and first crypto legislation in the US, setting up a regulatory framework for crypto stablecoins.

Trump Media & Technology Group, the parent of Truth Social, has submitted a Form S-1 registration with the SEC to launch an ETF that directly holds both Bitcoin and Ether, allocating 75% to BTC and 25% to ETH.

Open interest sidelined

Key insights

After matching May’s peak of over $11B, perpetual open interest has fallen and has been trending sideways over the past seven days. The initial drop in open interest from $11B toward $9B occurred between Jun 11–13, 2025, coinciding with reports that the US and China had agreed on “a framework on trade,” as well as the preliminary passage of the GENIUS Act, the first stablecoin legislation in the US. It passed in a 68-30 procedural vote which, at the time, pushed it toward one final vote in the Senate.

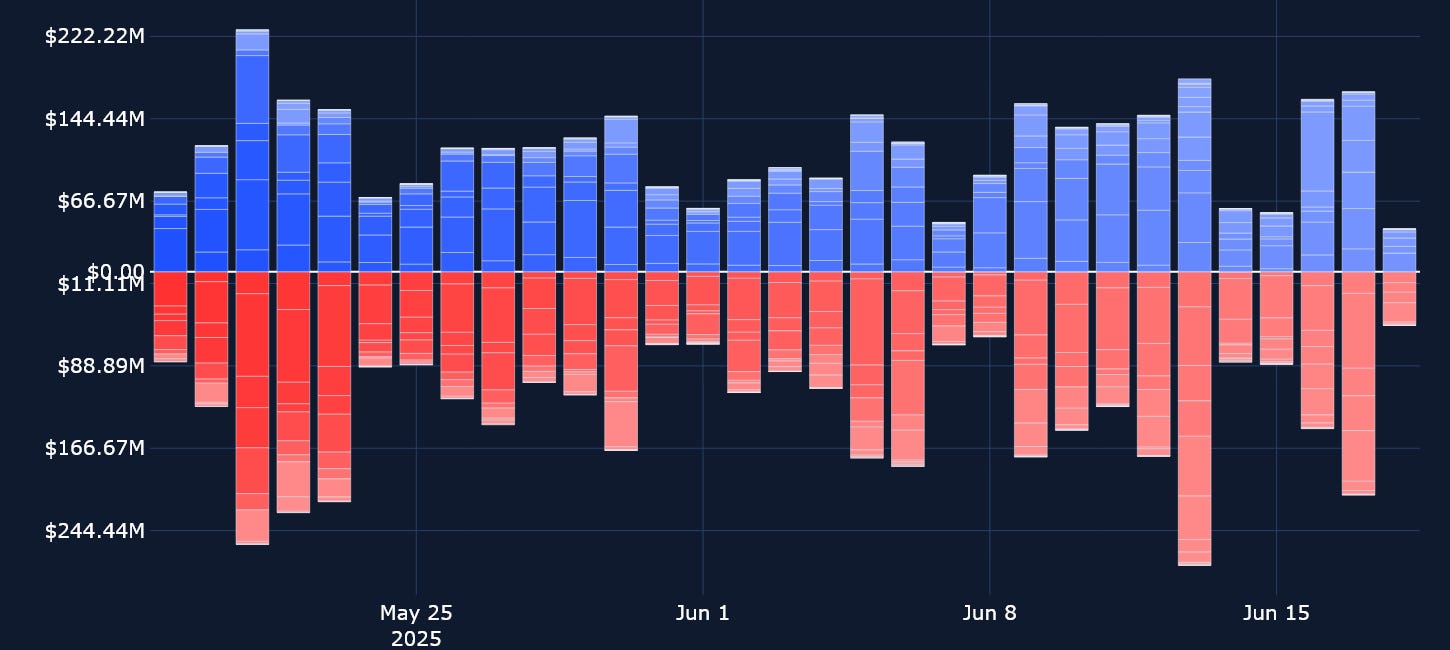

Since then, open interest has mainly been flat, despite tensions in the Middle East flaring up, and a number of tokens seeing negative perpetual funding rates on the first day of the conflict between Israel and Iran. Perp trading volume saw a more clear reaction to the Middle East conflict — on Jun 13, 2025, perp volumes reached their highest levels this month, exceeding $26B as BTC’s spot price dipped toward $103K.

BYBIT PERP OPEN INTEREST — BTC open interest has been flat at $5B after an initial drop on June 11.

BYBIT PERP TRADING VOLUMES — Daily trading volume in perps peaked on June 13, the first day of the Iran-Israel conflict, exceeding $26B.

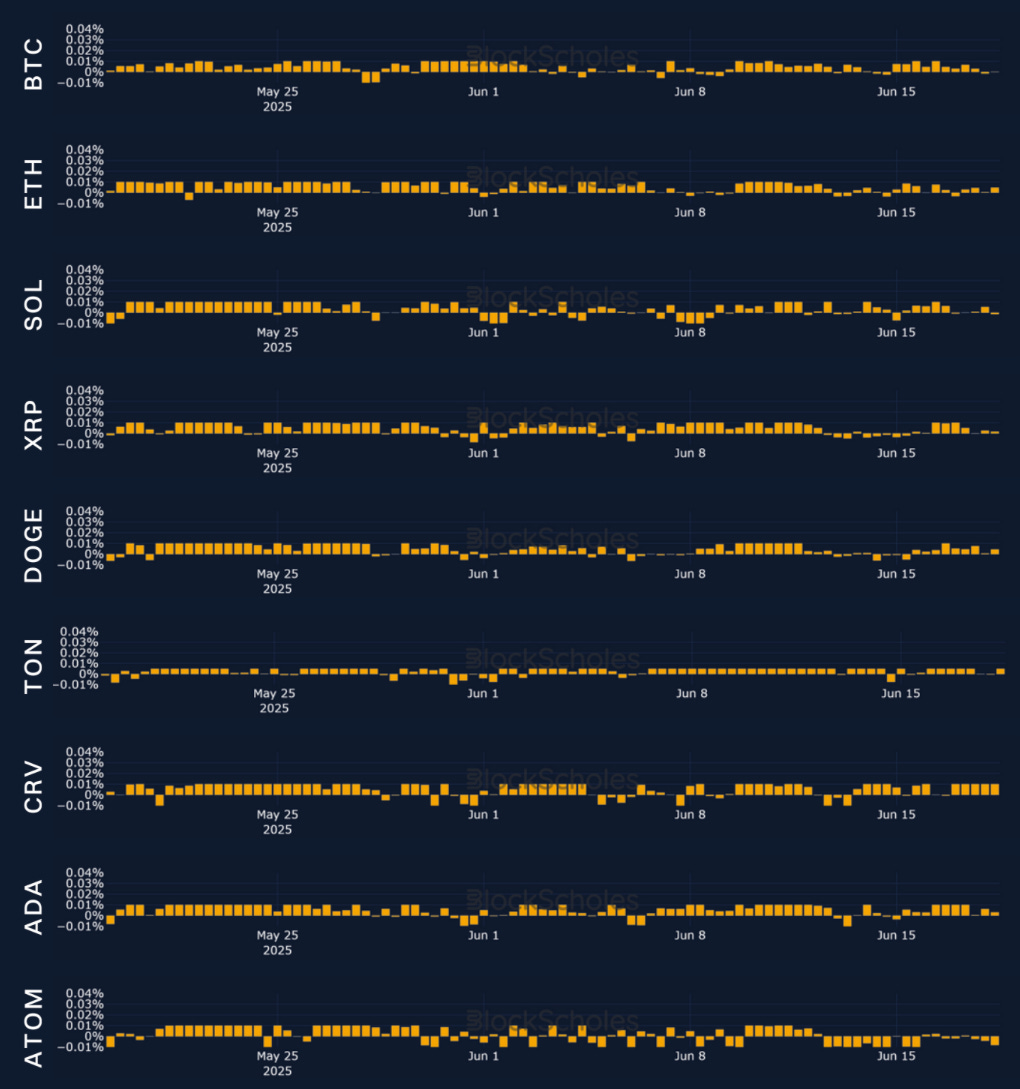

Funding takes a hit

Funding rates for most of the nine tracked crypto tokens turned negative following reports on Jun 13, 2025 that Israel had launched a preemptive strike against Iran. That was a clear sign to crypto markets that President Trump’s trade war was not the only major geopolitical driver of spot and derivatives markets. While funding for ETH, SOL, XRP and DOGE turned negative, BTC only registered one negative funding rate as the conflict began, holding up better than the aforementioned tokens. Over the past week, funding rates for the majority of tokens have fluctuated between positive and negative values, but on the whole remain lower than levels seen at the tail-end of May to the first week of June.

BTC options

Key insights

Over the course of the past week, BTC has traded as high as $110K (just shy of its ATH) and as low as $103K, which appears for the most part to have been a floor for its spot price in June. The 7-day realized volatility for BTC has moved sideways at 30%, more than half the realized volatility at an equivalent look-back window for ETH. That goes some way in explaining the nearly 2x ratio between the respective 7-day implied volatilities for ETH and BTC.

Compared to the first week of June, when options volumes were relatively balanced between calls and puts, recent put volumes have far exceeded those of calls. On Jun 13, 2025, that divergence was as large as $100M. Open interest in BTC options is also currently dominated by puts. On the whole, BTC options markets portray a bearish picture, as short-tenor volatility smiles are skewed toward OTM puts, and volume and OI are also put-dominated.

BYBIT BTC OPTIONS VOLUMES

BYBIT BTC OPTIONS OPEN INTEREST

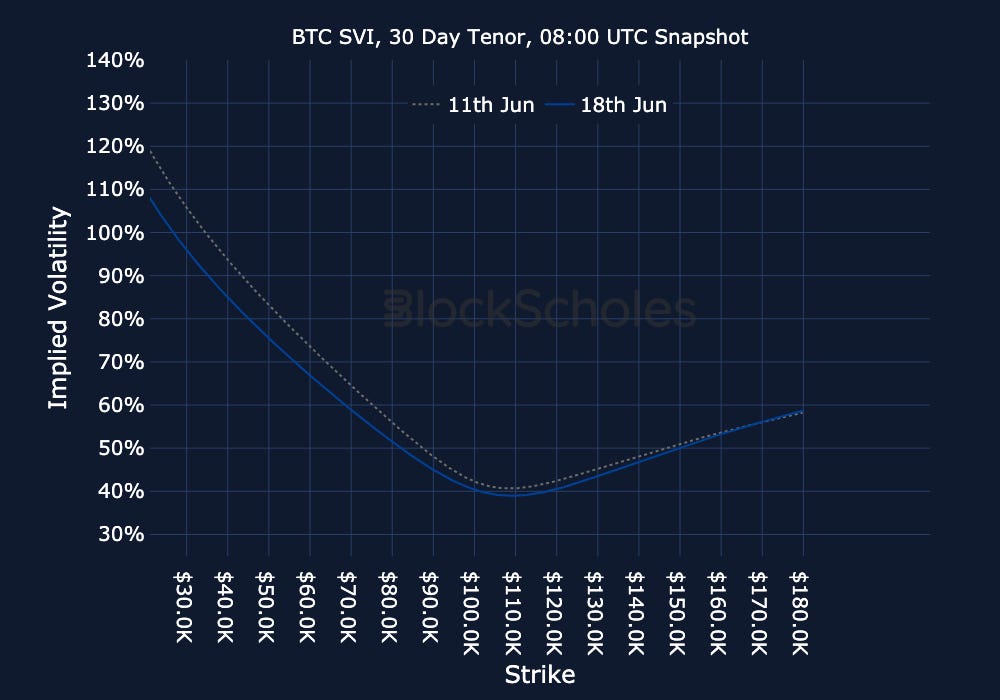

BTC volatility remains low

BYBIT BTC ATM TERM STRUCTURE — BTC front-end volatility continues to trade below 40% and has dropped by 1–2 percentage points as compared to last week.

BYBIT BTC SVI ATM IMPLIED VOLATILITY — The term structure of implied volatility for BTC continues to contrast with ETH’s, sloping upward in contrast to ETH’s almost flat shape.

BYBIT BTC IMPLIED AND REALIZED VOLATILITY — Realized volatility provides some insight into the low levels of implied volatility, and has hovered at 30% for most of the month.

ETH options

Key insights

ETH’s spot price has underperformed BTC’s over the past seven days, now down nearly 9% and trading at $2,500 (relative to a smaller 4% decline in BTC). However, sentiment in ETH options markets is holding up slightly better than in BTC’s markets. Short-tenor smiles hold a less bearish skew toward OTM puts, and both open interest and options volumes are (in contrast to BTC) dominated primarily by call options.

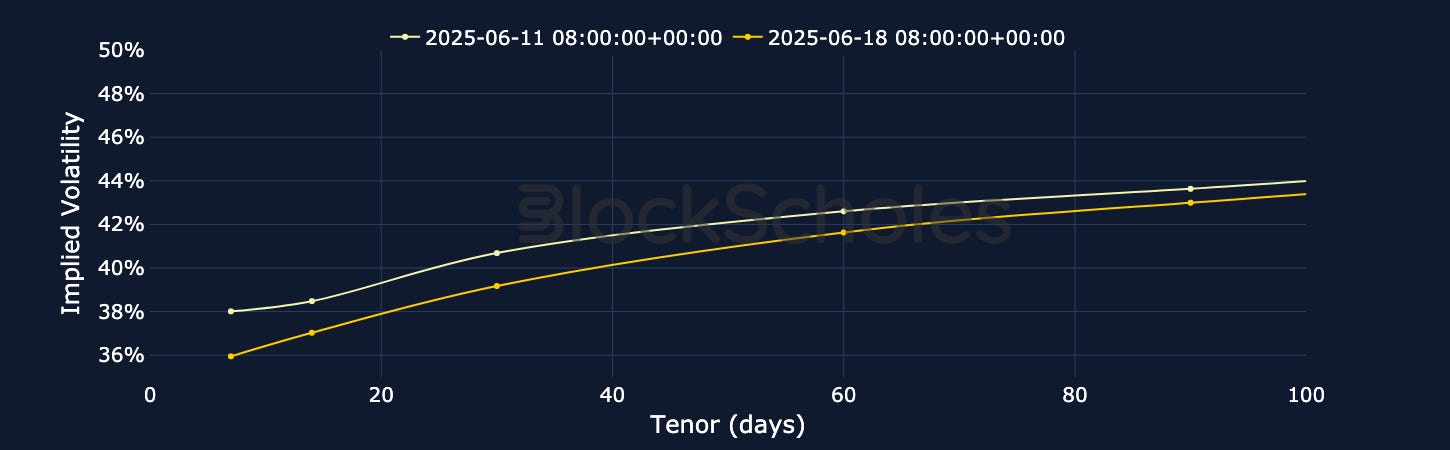

The contrast with BTC doesn’t end here, either: ETH’s term structure of volatility — which, as we’ve noted on several occasions, is at outright higher levels of volatility — has mostly been inverted, relative to the “normal” upward slope exhibited in BTC’s term structure. Over the past week, however, that inversion has flattened, with the divergence between short- and long-tenor ETH options narrowing. On Jun 11, 2025, the divergence between 7- and 90-day options was 7 percentage points; now it’s only 3 points.

BYBIT ETH OPTIONS VOLUMES

BYBIT ETH OPTIONS OPEN INTEREST

Inversion, flatten, inversion

BYBIT ETH VOLATILITY TERM STRUCTURE — In a pattern we’ve seen repeatedly, ETH’s term structure is fluctuating between an inverted and a flat state.

BYBIT ETH SVI ATM IMPLIED VOLATILITY — Short-tenor volatility for ETH has dropped from its highs of 77% earlier this month, and is now down to 70%.

BYBIT ETH IMPLIED AND REALIZED VOLATILITY — ETH realized volatility remains more than 2x greater than BTC’s delivered volatility over the past seven days, while ETH 30-day implied volatility and 7-day realized volatility have now also converged.

SOL options

The pattern of de-risking in crypto markets and US equity markets over the past week hasn’t fared well for SOL, either. SOL’s spot price is trading 10% lower, relative to its Jun 11, 2025 price of $167, and is more than $100 below its January 2025 ATH. Despite this, open interest and options volumes are markedly dominated by call options — since the start of June, options volumes have risen exponentially from $3M to $8M. SOL’s term structure of volatility also continues to remain the most unique to decipher, as the belly of the curve is lifted, while the front-end carries a 3 percentage point premium to the back-end.

BYBIT SOLUSDT OPTIONS VOLUMES

BYBIT SOLUSDT OPTIONS OPEN INTEREST

SOL volatility has inverted

BYBIT SOL VOLATILITY TERM STRUCTURE — Volatility levels remain lower than last week, particularly for the 7-day tenor, which has dropped 10 points.

BYBIT SOL SVI ATM IMPLIED VOLATILITY — Implied volatility for SOL is now trading close to the lows seen at the start of the month.

BYBIT SOL IMPLIED AND REALIZED VOLATILITY — 7-day realized volatility is now more than 10 percentage points higher than 30-day implied volatility — a stark contrast to last week, when the latter was 7 percentage points higher than realized volatility.

ETH skew is less bearish

Key insights

Volatility smiles for ETH are bullish for horizons beyond 30 days. For expirations at less than 30 days, ETH options carry a 2 percentage point premium toward OTM puts. That premium has fallen considerably from June 14, when it was as large as 9.5 percentage points. Meanwhile, BTC options markets paint a more bearish picture — 90-day options carry a slightly positive 0.45% skew toward out-of-the-money calls, while all other tenors remain put-skewed — with 7-day BTC options assigning a 3-point volume premium toward puts. However, this sentiment does contrast with what we see in perp funding rates between the two assets: BTC’s funding rates have mostly held up more positively over the past seven days as compared to ETH’s funding rates.

BYBIT BTCUSDT CALL-PUT SKEWBYBIT ETHUSDT CALL-PUT SKEW

Volatility by exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Bybit volatility surface

Constant maturity smile

Data & methodology

Data acquisition, composition & timeline

Open interest and trading volume data are sourced “as is” from the Bybit exchange platform API exclusively, and as such do not represent a comprehensive picture of the sum of trading activity across all derivatives markets or exchanges. The data visualized in this report consists of hourly and daily snapshots, recorded over the previous 30 days. Daily (hourly) snapshots of trade volume record the total sum of the notional value of trades recorded in the 24H (1 hour) period, beginning with the snapshot timestamp.

If not explicitly labeled as derived from another exchange, the input instrument prices to all derivatives analytics metrics in this report are sourced from the appropriate endpoints of Bybit’s public exchange platform API. In the event that data is labeled or referred to as representing the market on another exchange source, that data is sourced from the appropriate endpoint of each respective exchange’s public API.

Macroeconomic charts and data are sourced “as is” from the Bloomberg Terminal. Exchange data is sourced “as is” from publicly available exchange APIs. Block Scholes makes no claims about the veracity of public third-party data.

Open interest & volume dollar denomination

After acquisition of underlying-denominated raw data for open interest and trading volume on the Bybit exchange platform from Bybit’s API endpoint, equivalent dollar-denominated figures are calculated using the concurrent value of Block Scholes’s Spot Index for the relevant underlying asset.

Block Scholes’s Spot Index represents the aggregate Spot mid-price for a given currency across the top five CEXs by volume (with USD-quoted markets). It considers the proportion of total volume in the instrument on the exchange, as well as the deviation of a data point from those on other exchanges.

Block Scholes–derived analytics metrics

Futures prices are used for Block Scholes’s futures-implied yields calculation services in order to derive the constant-tenor annualized yields displayed in the Futures section of this report.

Options prices are used for Block Scholes’s implied volatility calculation services in order to calibrate volatility surfaces, from which all derivatives volatility analytics displayed in the BTC Options and ETH Options sections of this report are calculated. Volatility smiles are constructed by calibrating to mid-market prices observed in Bybit options markets. As part of the calibration process, prices go through rigorous filtration and cleaning steps, which ensures that the resulting volatility surface is arbitrage-free and has exceptional fit to the market observables.