Crypto Selloff Deepens

BTC’s selloff deepened, dropping 4.65% to break below $90k and leaving it almost 29% off its early-October $126k ATH, while ETH fell 5.1% back under $3k and US equities also pulled back.

📉 Crypto slide deepens

BTC has broken below $90K for the first time in seven months, while ETH is back under $3,000, with both coins extending double-digit drawdowns from their October highs. The risk-off tone is no longer confined to digital assets either, with the S&P 500 and Nasdaq-100 both slipping from recent peaks.

🧭 Policy focus shifts, even as cuts stay in play

Fed vice chair Jefferson and governor Waller both flagged rising labour-market risks and argued the case for another 25bp cut in December, even as tariffs keep headline prices noisy. At the same time, the SEC’s exams unit dropped crypto from its 2026 priority list, choosing instead to focus on AI and automation.

🌐 Adoption and product news keep coming

El Salvador announced its largest single-day BTC purchase to date, Coinbase is listing TON, Cboe is preparing long-dated “Continuous Futures” on BTC and ETH, VanEck’s VSOL ETF offers staked Solana exposure, and Aave has launched an app pitching 6% yields with balance protection up to $1M.

⚡️ Free readers stop here. Paid subs get our full daily market snapshot — quick, clear, and easy to follow.

👉 Upgrade to paid to unlock the full experience and stay ahead, every single day.

Find out our latest reports, listed below:

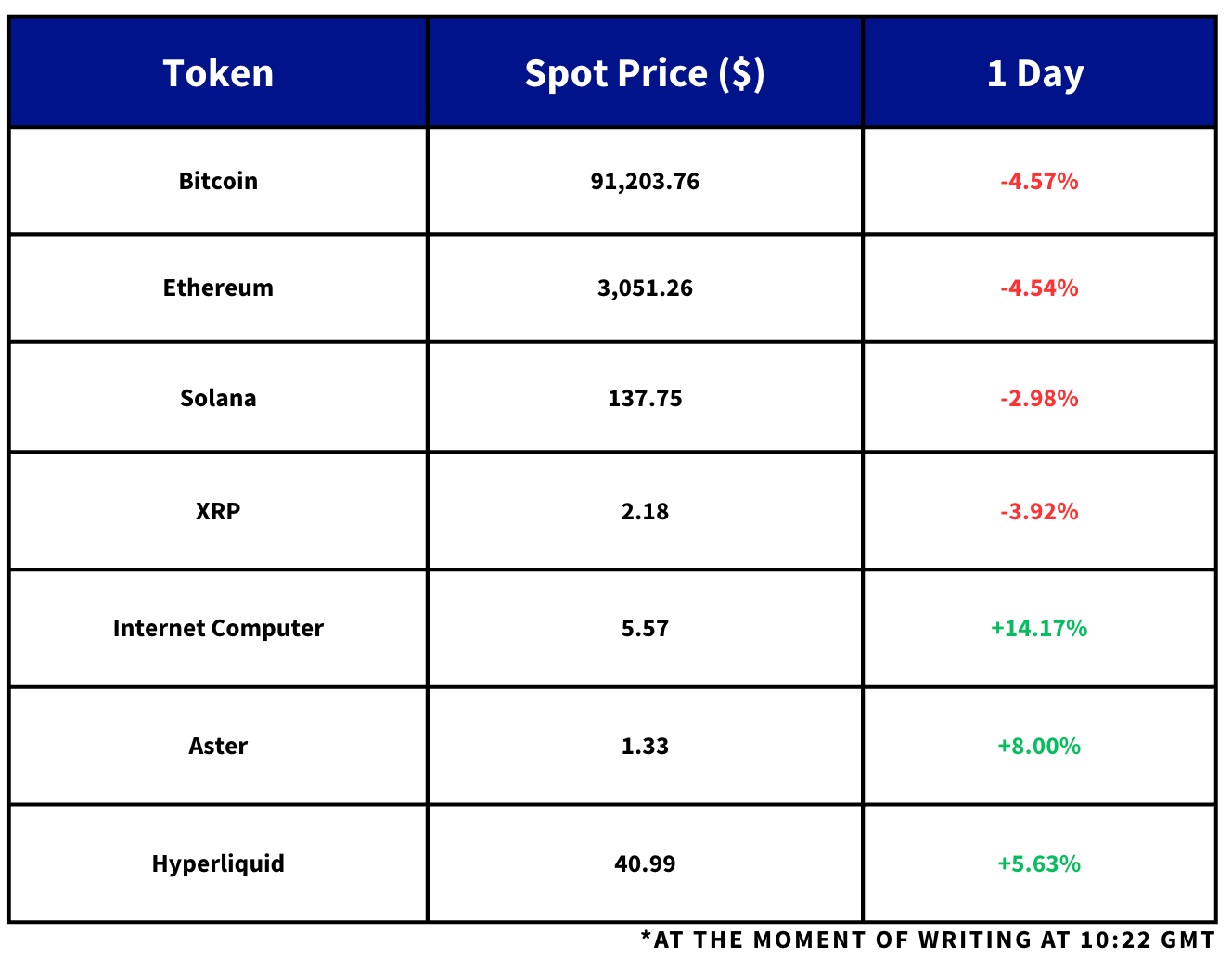

Market Snapshot: Overnight Moves

Daily Updates:

The selloff in crypto markets continues to deepen, as BTC fell below $90K for the first time in seven months, further extending the plunge from its ATH of $126K in early October.

Over the past 24 hours, BTC is trading 4.65% lower, while ETH once more fell below $3,000 during early Asian trading hours and is down 5.1%.

While the recent souring in risk appetite has been most apparent in the crypto market, US equities have also slipped from their recent highs, with the S&P 500 closing 0.92% lower yesterday while the tech-heavy Nasdaq-100 fell 0.83%.