“WE ARE SO BACK”

BTC has retraced to ~$102k from >$107k, with derivatives and ETF flows signalling weak dip-buying: short-tenor futures are below spot, option skews are put-heavy, and spot ETFs have offloaded ~$71m of BTC since 29 Oct. US risk assets diverged

📉 BTC under pressure

BTC has faded from above $107K to around $102K, with futures trading below spot and options still paying up for downside — a market that’s not yet buying a full recovery back to the highs.

🏛️ Shutdown ends, data fog remains

The record 43-day US government shutdown is over, but missing CPI and jobs reports leave the Fed flying blind into December, with officials openly split on how much further they can cut.

🧱 Crypto policy & plumbing

The SEC’s new “token taxonomy”, MAS’s tokenised bill pilot, Franklin Templeton’s latest tokenisation push and Sui’s USDsui launch all point to the rails of digital finance quietly being rebuilt beneath the price action.

⚡️ Free readers stop here. Paid subs get our full daily market snapshot — quick, clear, and easy to follow.

👉 Upgrade to paid to unlock the full experience and stay ahead, every single day.

Find out our latest reports, listed below:

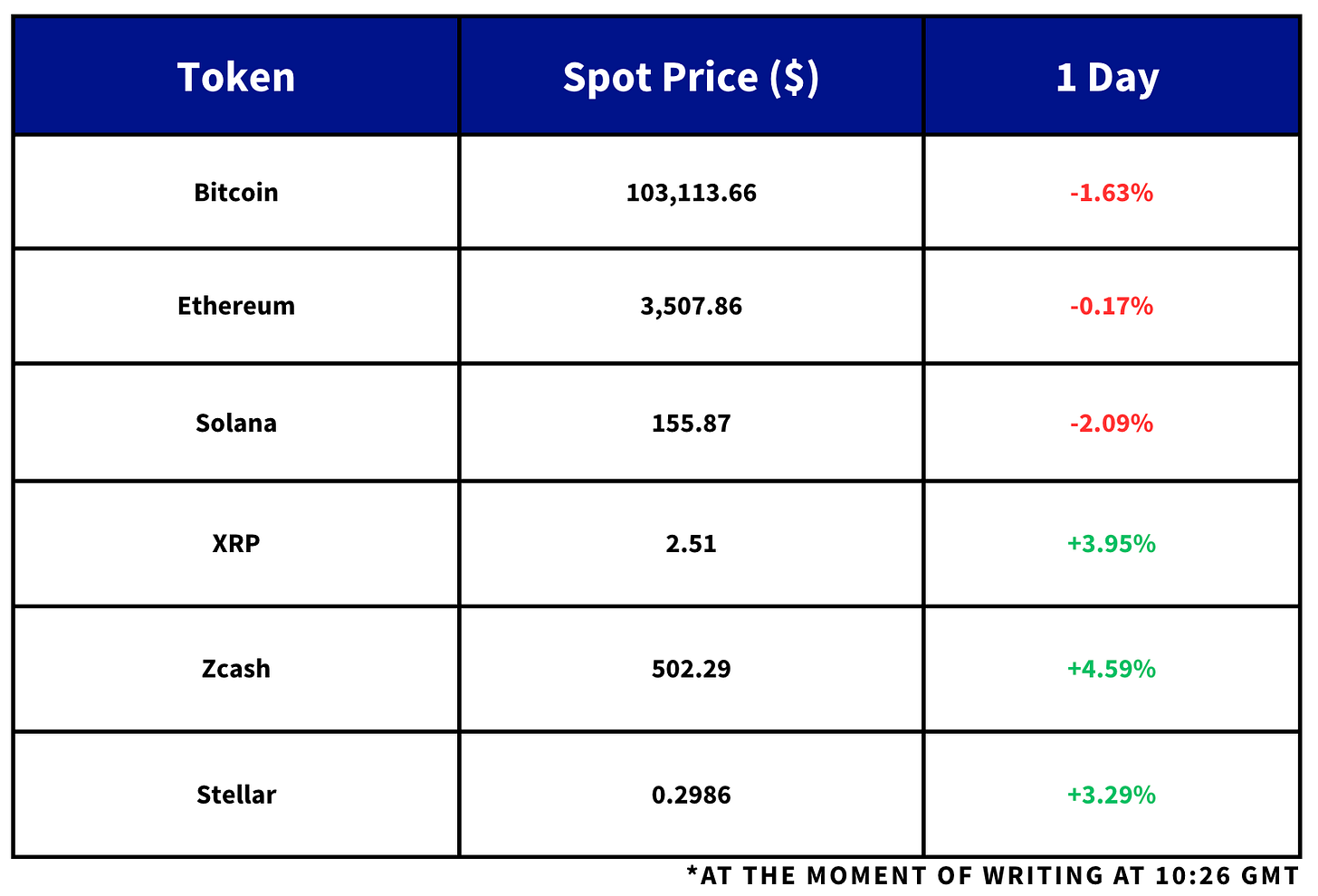

Market Snapshot: Overnight Moves

Daily Updates:

After exceeding $107K earlier in the week, BTC now trades at $102K with few signs of recovery from the downward trend that began from mid-October.

Funding rates in perpetual swap markets are modestly positive (though that’s an improvement from earlier in the week when they dipped below 0%), short-tenor futures yields are negative — suggesting futures prices trade below spot price, and in options markets, tenors across the term structure all trade with a premium towards put contracts.

That lack of conviction from derivatives markets for any meaningful recovery back towards ATH’s for BTC is also reflected in Spot Bitcoin ETF inflows.

Between Oct 29, 2025 and Nov 5, 2025, Spot ETFs saw 6 consecutive days of outflows. Since Nov 6, 2025, flows have fluctuated, though over the whole period, Spot ETFs have still sold $71.4M of bitcoins.

While crypto continues to lag behind, US equities pushed higher for another session with the S&P 500 closing 0.93% higher, while US treasury bond yields fell.